The global apparel market is expected to recover and grow from $1.55 trillion in 2021 to $1.7 trillion in 2022, the latest fashion industry statistics tell us. At the same time, both consumers and brands are becoming increasingly aware of the importance of sustainable fashion.

The thing is:

While the size of the fast fashion market keeps growing, more and more consumers and fashion companies are looking at the environmental and ethical dimensions of sustainability. Inclusion, diversity, vegan alternatives, and sustainable procurement are influencing industry decision-makers.

Check out all the global fashion industry statistics below.

Trendy Fashion Industry Stats (Editor’s Picks)

- In 2022, the global apparel industry market size is projected to reach $1.7 trillion.

- 20,000 to 25,000 stores were expected to close in the United States in 2020.

- In 2021, experts predicted a 30% growth in online fashion sales in the US.

- Fast fashion industry statistics forecast that the fast fashion market size will reach $39.84 billion by 2025.

- 40.6% of all castings across New York, London, Milan, and Paris went to models of color.

- 77% of people think it’s very/somewhat important that fashion brands tackle gender inequality.

- 58% of US consumers agreed that they would spend more if goods were ethical.

- Companies with above-average diversity in management produced a 19% higher “innovation revenue” than that of companies with below-average leadership diversity.

The Fashion Industry After Covid-19: Statistics in 2020 and 2021

1. In 2020, more than 65% of consumers planned to spend less on clothes.

(McKinsey)

The combination of staying at home and worrying about finances led the majority of consumers to reprioritize. As the situation continues further into 2021, Mckinsey predicts that the industry won’t be returning to pre-pandemic sites before at least late 2023.

2. Before the pandemic, 34% of fashion businesses in North America and Europe had already been going through financial troubles.

(McKinsey)

The pandemic came at the right moment to accelerate the necessary changes in the fashion industry. Although many retailers focus on saving themselves while laying off workers at the start of the supply chain, the general consumer sentiment might be their biggest challenge. Different reports show that in 2020, many consumers reconsidered their approach to shopping.

3. In 2021, experts predicted a 30% growth in online sales in the US.

(McKinsey)

Fashion moguls such as Nike are focusing even more on their digital strategy. While this could help preserve the fashion corporations, it could spell out layoffs for a number of workers in brick-and-mortar stores. Still, online commerce is bound to remain the pillar of the fashion industry in 2021 as well.

4. 20,000 to 25,000 stores were expected to close in the United States in 2020.

(McKinsey)

This number shows the seriousness of the brick-and-mortar retail situation in 2020 and 2021. Unfortunately, the figure is more than two times higher than in 2019.

Fashion Industry Statistics: Inclusivity and Diversity

5. Companies with above-average diversity in management produced “innovation revenue” that was 19% higher than that of companies with below-average leadership diversity.

(Vogue Business)

Fashion’s lack of diversity has real costs. Society expects a greater representation of differences. There are also strong economic reasons for diversity. The more consumers are visibly represented and feel bound to the brand in terms of shared values, the greater the turnover for the fashion companies.

6. 56% of fashion employees have attended a professional course or workshop on inclusivity and diversity in the workplace.

(CFDA Insider/Outsider Report)

Both consumers and workers are pushing fashion companies to become proactive advocates of inclusivity and diversity in the fashion industry. A survey of employees in the United States apparel industry shows that more and more companies are making that a top priority, anchored throughout the company and in leadership positions. Companies’ efforts are also increasingly scrutinized for honesty and results.

7. 62% of employees rated their organization’s commitment to an inclusive workplace as 3 out of 5 when considering the impact on the organization’s success.

(CFDA Insider/Outsider Report)

A questionnaire sent out to some 50 senior-level participants from over 30 fashion companies concluded that the industry rated itself as average in its assessment of inclusion and diversity efforts.

8. 36% of respondents rated their organization with an average score of 3 out of 5 when it comes to assessing the extent to which different groups feel able to make their full contribution.

(CFDA Insider/Outsider Report)

For many years, diversity meant occasionally putting a non-white face on the cover of a magazine. It was usually all about visual impact. Today, diversity is gradually making way for real inclusion. The fashion industry is starting to embrace meaningful change, which is great news.

Fashion Modeling Industry Statistics

9. 40.6% of all castings across New York, London, Milan, and Paris went to models of color.

(The Fashion Spot)

While the 2020 spring season was the most racially diverse ever, there was a slight decline in the fall of 2020, from a high of 41.5% to 40.6%. But that’s not so devastating because fall 2020 is still the second most racially diverse season since The Fashion Spot began reporting.

10. Only 1.4% of all castings went to plus-size models.

(The Fashion Spot)

The spring season 2020 was really impressive. A record number of 68 plus-size models (2.92%) walked a total of 19 shows. The size diversity in autumn 2020 dropped to a disappointing 27 appearances in 16 shows, which is only 1.4%.

Apparel Industry Statistics: Gender Inequality

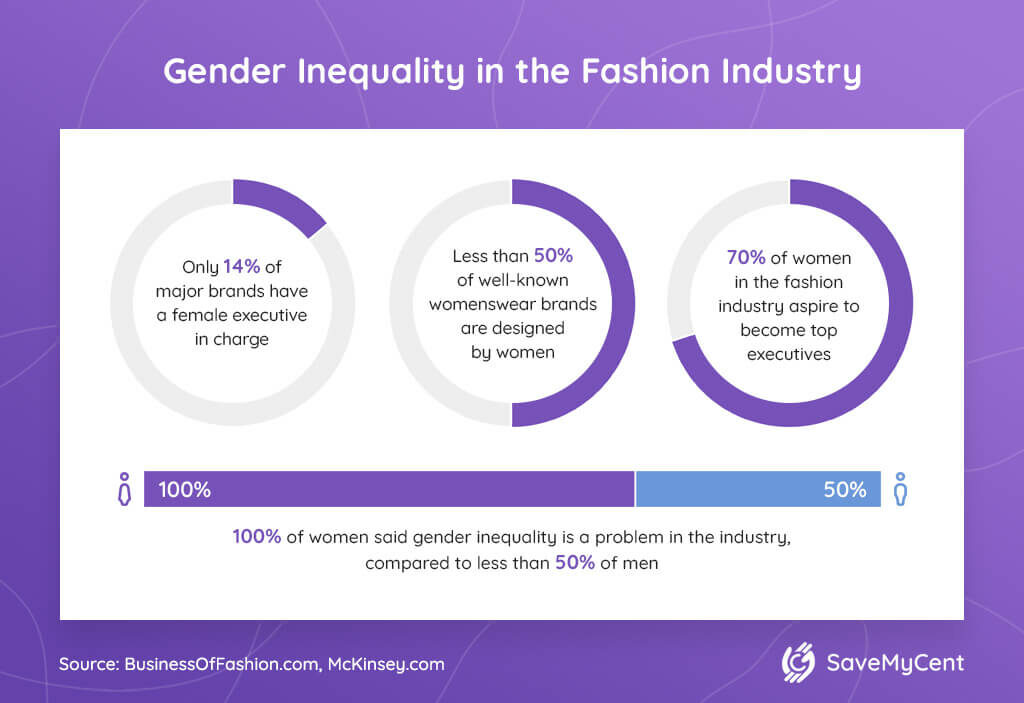

11. Only 14% of major brands have a female executive in charge.

(Business Of Fashion)

The fashion industry is driven by women. They spend three times as much on clothing as men and occupy the majority of entry-level positions, according to fashion industry employment statistics. Companies that manage to be diverse and inclusive are among the biggest success stories in fashion and retail.

But while many companies have committed themselves to increasing gender diversity, progress has been slow.

12. Less than 50% of well-known womenswear brands are designed by women.

(Business Of Fashion)

Although women are the primary end consumers of fashion items, they’re still underrepresented in leadership positions throughout the industry.

The fact remains:

The majority of fashion houses are still run by male designers.

Moreover, fashion designers can earn decent money. The average annual salary for fashion designers in the US is $74,410 per year or $6,200 per month.

13. 70% of women aspire to become top executives.

(McKinsey)

Women start their fashion careers with higher ambitions than men. But these ambitions are not cultivated along the way, and they become more frustrated and disillusioned with every obstacle they encounter.

Now:

The lack of senior leaders is obviously not the result of some kind of ambition gap. Women hit a glass ceiling in the middle of their career. On the other hand, men, when they reach this VP level, are 20% more likely than their female peers to get a leadership position.

14. 100% of women said gender inequality is a problem in the industry, compared to less than 50% of men.

(McKinsey)

The four main causes of gender inequality are a lack of awareness and commitment, unclear criteria for success, disparity in sponsorship and mentorship, and limitations in the reconciliation of work and private life.

What are companies doing to address this issue? And how do consumers feel about gender inequality?

Let’s try to find out:

15. 77% of people think it’s very/somewhat important that fashion brands tackle gender inequality.

(Fashion Revolution, Clean Clothes Campaign)

The fashion industry is powered by an estimated 40 million garment industry workers to generate its billions in profit. Approximately 80% of garment workers are women. That’s part of a wider integrated business model creating obstacles for workers to enjoy their basic rights at work.

Fashion Industry Trends: Leather Alternatives

16. 16% of the luxury audience engaged with animal rights in relation to fashion sustainability.

(entSight)

Luxury fashion is naturally associated with the fur industry. As more and more luxury brands and retailers ban fur, industry associations are promoting the sustainability of the fur industry.

In response, the fur industry is promoting fur as a sustainable and natural option by investing in industry-wide certification programs and education. This does not prevent consumers from considering animal rights in relation to fashion sustainability.

17. 30% of people said it was important that the clothes they bought (including shoes and accessories) are produced without harming animals.

(Fashion Revolution)

Other survey results show that animals’ rights influence purchasing decisions.

Fashion Revolution publishes the Fashion Transparency Index, which annually assesses the progress of the fashion industry in terms of transparency. It reviews and ranks 200 of the largest global fashion and apparel brands and the retail fashion industry according to the amount of information they disclose about their suppliers, supply chain policies and practices, and social and environmental impacts.

18. 27% of US adults think leather is either a “somewhat or very inappropriate material” to use in clothing.

(Vogue Business)

A survey of 2,000 people in the UK and the US conducted in September 2019 showed that 20% of all respondents in both countries said that they had changed their opinion about the material in the last five years. As demand for furs declines, brands are turning to vegan leather and fur alternatives. As a result, the global artificial fur fashion market size is estimated to grow.

19. The number of shoes available described as “vegan” increased by 27% YoY in the US.

(Edited)

Since 2018, there has been steady growth, and products that are called “vegan” have grown in popularity. According to the facts of the fashion industry, there has been a 64% year-on-year increase in the US for products labelled “vegan.” Edited data shows that stocks of “vegan” products in the UK and the US have increased by a mind-blowing 258% year-on-year, especially in the footwear, accessories and outerwear categories.

Fashion Industry Environmental Impact Statistics

20. 28% of the luxury audience addressed environmental sustainability within the fashion industry.

(entSight, Global Fashion Agenda)

Clothing consumption is expected to increase by 63%, from 62 million tons today to 102 million tons in 2030. The Pulse of the Fashion Industry Report warns that if we continue to produce and consume at this rate, environmental and social pressures will increase so much by 2030 that the growth of the industry itself will be threatened.

21. Fast fashion industry statistics reveal that the fast fashion market size will reach $39.84 billion by 2025.

(Statista, Research and Markets)

Fast fashion statistics show that this segment of the industry still has a significant market size of $30.58 billion in 2021. Although many retailers are closing their stores, fashion retail industry statistics show the online fashion industry continues to generate growth. The market is expected to recover in 2023, however, as consumers’ mindsets change, the fast fashion industry has a bumpy road ahead.

22. The fashion industry accounts for an estimated 8% of the world’s greenhouse gas emissions.

(Quantis)

In a business-as-usual scenario, the climate impact of the apparel industry is projected to increase by 49% by 2030, meaning that the apparel industry alone will emit 4.9 gigatonnes of CO2 equivalent, which is almost the entire annual US greenhouse gas emissions of today.

23. 50% of greenhouse gas (GHG) emissions of the apparel market come from dyeing & finishing, yarn preparation, and fiber production.

(Quantis)

The clothing industry alone is responsible for 6.7% of global greenhouse gas emissions. As global production is concentrated in Asia, GHG emissions in these phases are driven by the dependence of garment production on coal and natural gas for power and heat generation.

24. 37% of people said it is important that the clothing (including shoes & accessories) they buy is produced in a way that is not harmful to the environment.

(Fashion Revolution)

The world is increasingly aware of the impact of fashion production and consumption on the planet and is continuing to educate itself. Brands are striving to promote their sustainability efforts to attract younger consumers who care about how and where their clothes are made.

Interest in sustainability continues to grow. According to the US fashion industry statistics, sustainability receives an average of 90,500 Google searches per month.

25. 85% of the respondents think it’s very/somewhat important that fashion brands tackle climate change.

(Fashion Revolution)

The pollution statistics of the fashion industry provide clear evidence to both fashion companies and fashion consumers that the current practice of producing and manufacturing clothing (including shoes and accessories) is highly polluting and unsustainable.

Clothing Industry Statistics: Ethical and Social Dimensions

26. 58% of US consumers agreed that they would spend more if goods were ethical.

(entSight)

According to entSight’s Sustainable Fashion Report, people who have bought products from a mid-sized fashion brand are more willing to invest in sustainable products, with the index 39% higher than the average consumer. In addition, the US luxury public is more likely to buy sustainably than high street shoppers.

27. 83% of Asia-Pacific Mid-Market audiences are more likely to pay extra for ethical products.

(entSight)

Sustainable fashion statistics show the following results based on fashion demographics:

The luxury Asia-Pacific audience had the most positive reactions to ethical products. Asian countries have the greatest appetite for sustainable fashion.

28. 80% of male luxury fashion purchasers said they would pay more for sustainable clothes.

(entSight)

Although the attitude to pay more for sustainable products did not differ according to gender, male buyers of luxury fashion developed into an audience that invested particularly in sustainability as a brand segment.

Indeed, male luxury fashion buyers are willing to pay 43% more for sustainable clothing than the average consumer. Male buyers of luxury fashion items are particularly interested in sustainability.

29. 36% of the audience want brands to include innovative new products.

(Edited)

This audience may be receptive to new ethical materials and production techniques that increase their credibility. The material revolution is the next big thing in fashion.

30. 35% of companies have robust remediation plans to redress child or forced labor if it is found in their supply chain.

(Baptist World Aid)

Fashion production in the entire Asia-Pacific region is plagued by slavery and child labor. Although safety standards have improved, fire safety, structural deficiencies in factories, and unsafe working conditions remain a cause for concern. As a result, more and more companies are seeking to help eradicate child or forced labor wherever it’s found in their supply chain.

31. 80% of people think fashion brands should disclose their manufacturers.

(Fashion Revolution)

More and more consumers are demanding transparency from brands about their supply chains. In fact, 38% of people consider the social impact before deciding whether or not to buy an item.

What’s more:

39% of people think it’s important that the clothes, shoes, and accessories) they buy are made by workers who receive a fair, living wage.

Finally, 31% of people said it’s important that the clothes they buy are made under safe working conditions.

32. Fashion industry statistics show a 49% growth of products described as “eco,” a 173% growth of “recycled,” and a 25% growth of “conscious”.

(Edited)

Retailers and consumers can adapt to improve their environmental footprint. There are several strategies that are constantly evolving as brands and retailers work towards a more sustainable future for fashion.

As sustainable and green initiatives hit the headlines every day, this change is evident in the way retailers communicate with their customers. As the year progresses, more and more people are talking about sustainability.

33. Since 2017, there has been an 83% increase in products described as containing organic cotton in the US.

(Edited, Research and Markets)

Data analysis from market research in the fashion industry reveals the number of products described as “sustainable” that arrive online in the US and the UK has increased by 125% since 2017.

Based on the number of styles described as products containing organic cotton in the US and UK, tops are the most commonly used product made with this fiber. This is evident in the women’s and men’s apparel segment. The size of the sustainable fashion market has experienced rapid growth from 2016 to 2018, only to drop by 3.24% in 2020, when it was estimated at $6.14 billion.

Fashion Industry Analysis: Sustainable Sourcing Landscape

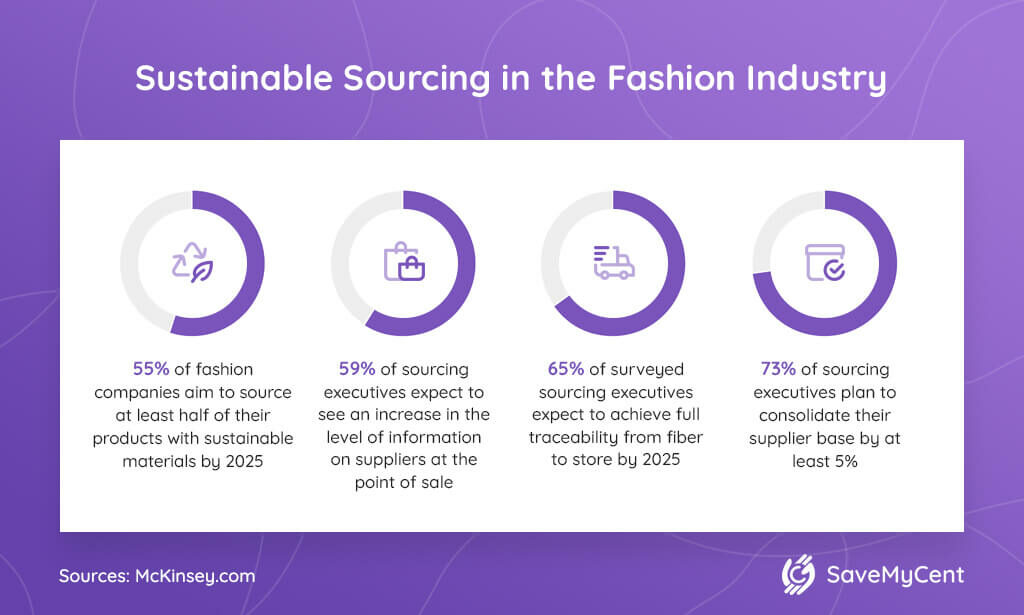

34. 55% of fashion companies aim to source at least half of their products with sustainable materials by 2025.

(McKinsey)

According to the global statistics of the fashion industry, the share of products with sustainable materials is still low today.

That being said:

Those responsible for procurement are planning a major expansion in the coming years. The various obstacles to implementation include the availability, cost and quality of materials.

35. 59% of sourcing executives expect to see an increase in the level of information on suppliers at the point of sale.

(McKinsey)

Few companies have achieved this transparency today, but eight out of ten procurement managers surveyed plan to increase transparency by 2025 in the form of supplier lists on their corporate social responsibility websites. Clothing companies should be transparent about their social and environmental sustainability performance and share this information with consumers.

36. 65% of surveyed sourcing executives expect to achieve full traceability from fiber to store by 2025.

(McKinsey)

Today, only one in ten companies today provides details about the properties, origin, and value chain of its sustainable fibers. Six out of ten companies plan to go even further and increase the level of product-specific information about their suppliers at the point of purchase.

37. 73% of sourcing executives plan to consolidate their supplier base by at least 5%.

(McKinsey)

Supplier consolidation is likely to accelerate in the coming years – and when it does, environmental and social sustainability performance will become a clear differentiator for suppliers. In the survey, nearly three-quarters of procurement executives said they planned to consolidate their supplier base by at least 5%.

This trend was particularly pronounced among larger companies. Most companies with a procurement value of more than $10 billion plan to consolidate their supplier base by more than 10%. Apparel companies are reducing the number of suppliers they work with to improve sustainability, efficiency, digitization, and speed.

38. 83% of respondents in a survey believed that physical samples would be used less often than virtual samples by 2025.

(McKinsey)

This reflects the high interest in virtual samples. The full value of virtual samples can only be achieved if the processes are transformed simultaneously. It has yet to be proven that companies can achieve the change management required to change the way people think, to embed new ways of working between functions and with suppliers, and to qualify personnel.

39. 42% of respondents believed that hazardous chemicals will no longer be used.

(McKinsey)

Chemicals are a major concern of the global fashion industry, and companies supported by initiatives are striving for zero-emission of hazardous chemicals into the environment. In this way, they can ensure that workers and consumers are not exposed to dangerous chemicals.

In addition, 6% of respondents believed that new, sustainable man-made textiles (including bio-based materials) will replace at least 20% of current textiles. Finally, 38% of respondents believed that waterless processing will be the norm (50% of production).

FAQ

Q: Is the fashion industry growing?

In 2020, the fashion industry was growing, until it wasn’t. Overall, the fashion industry could get back on its feet around 2022 or 2023 according to global fashion industry statistics from 2021. The pandemic has changed retail and affects all segments from luxury to fast fashion.

Despite the outbreak, some brands’ digital sales, such as Nike’s, have increased, fashion industry sales statistics reveal. From now on, digitalization is the key strategy for retailers, as the traditional brick-and-mortar stores are closed.

Recent studies show that instead of the V trajectory the fashion industry is more likely to experience elongated U-shaped recovery.

Q: How much is the fashion industry worth in 2022?

The global ecommerce fashion industry is estimated to grow to $872 billion by 2023. The online fashion industry growth rate is expected to reach a total market size of $991.64 billion by the end of 2024. The EU, the United States, and China have the largest apparel markets. According to IBISWorld, the global apparel industry market is worth $1.7 trillion in 2022.

Q: What is the market size of the fashion industry?

Although the initial forecasts for the global apparel market was an increase in value to around $1.7 trillion by 2022 the fashion industry is suffering from loss in sales due to the global pandemic. The sales of Inditex, the largest fast-fashion group, declined by 24%. Retail sales in Italy plunged by 25%, and a further 40% drop is expected. In China, the market is slowly recovering after a 50% slump in retail sales.

Q: What age group buys the most clothes?

In the UK, people between the age of 17 to 34 years old are the biggest consumers of apparel and clothing according to Statista. Globally, consumers aged 30 or below outside of China will grow to be more than double that of China by 2025, according to the McKinsey State Of Fashion 2022 Report.

Millennials and Gen Z are the consumer groups that are pushing the fashion industry for systematic change towards circularity and the demand for goods made in an ethical and environmental landscape. The industry must adapt to meet consumer needs as well as to help combat climate change and tackle the rising ethical issues.

Q: What to expect in the global fashion industry in 2022?

The systematic shift towards circularity and sustainability is evident in the fashion industry. The main priorities in the fashion industry are ensuring traceability in the supply chain, combating climate change, reducing environmental impact, and ensuring a safe and respectful working environment.

Other necessary changes in the fashion industry include ensuring better wage systems, sustainable materials, inclusiveness and diversity, and gender equality. For fashion companies to flourish, they must act strategically and address consumer concerns about the environmental and ethical aspects of the industry.

So, what did you make of the latest fashion industry statistics? Let us know in the comments below.

Sources:

- Vogue Business

- Vogue Business

- CFDA Insider/Outsider Report

- The Fashion Spot

- Business Of Fashion

- McKinsey

- Baptist World Aid

- Fashion Revolution

- Clean Clothes Campaign

- Edited

- Global Fashion Agenda

- Quantis

- Edited

- McKinsey

- Statista

- Omnilytics

- ReportLinker

- McKinsey

- McKinsey

- Research and Markets

- Research and Markets

- IBISWorld

![39 Thought-Provoking Fashion Industry Statistics [The 2024 Outlook]](https://savemycent.com/wp-content/uploads/thumbs_dir/How-To-Become-a-Fashion-Influencer-Featured-Image-qbszew0j1znchoe966yb3ln1ihcdyh16tiaf6ny8u4.jpg)

![39 Thought-Provoking Fashion Industry Statistics [The 2024 Outlook]](https://savemycent.com/wp-content/uploads/thumbs_dir/92-How-Much-Do-Fashion-Designers-Make-1-qbszpcxt6jzbtb6r17vpdgivpzqkp3ljxbw4mmfdj0.jpg)

![How to Get Free Clothes From Shein? [2024 Guide]](https://savemycent.com/wp-content/uploads/2023/09/How-to-Get-Free-Clothes-From-Shein-336x220.png)