Some people argue that cash is still king in the US. But there’s no denying that Americans love plastic more than paper.

Debit cards may be the most popular form of payment in the country, but credit cards are not that far behind. Actually, the US financial system incentivizes consumers to shop on credit.

The use of revolving credit is instrumental in pleasing FICO and VantageScore. Credit card purchases can be rewarding and safe because they can be disputed and reversed.

Check out these cherry-picked credit card statistics that show how plastic has fueled consumerism in the US and helped shape people’s way of life.

Top Statistics About American Consumers and Their Credit Cards

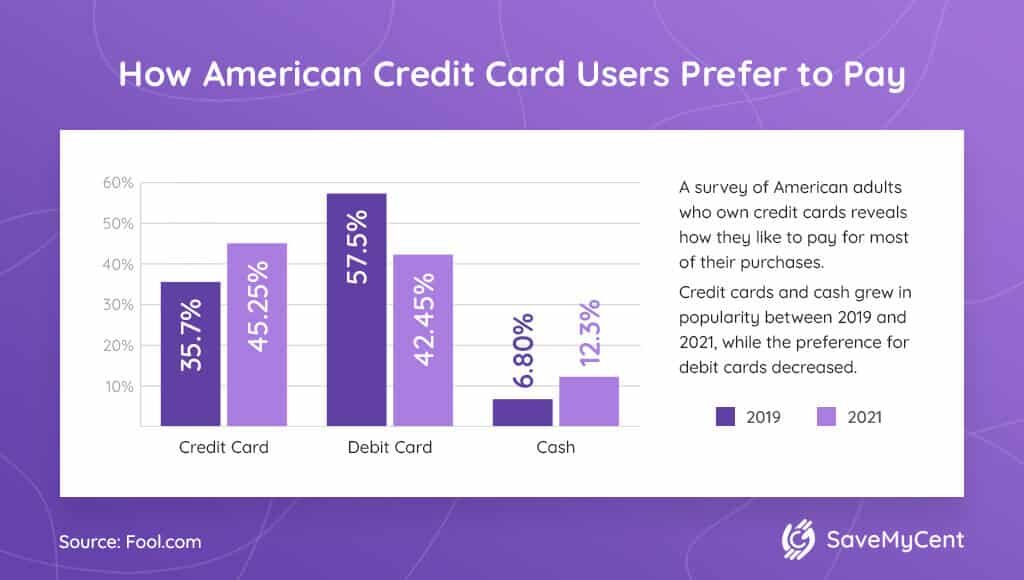

- 45.25% of US consumers usually pay for goods and services with a credit card.

- Over 70% of American households own general-purpose credit cards.

- People in the US used cash for only 28% of total transactions by volume in 2020.

- About eight out of ten Americans erroneously think that having high credit card balances matters to drive up credit scores.

- 55% of American credit cardholders are indebted.

- There are 505.54 million open credit card accounts across the US.

- The national average credit card debt per household decreased to $7,849 in Q3 2020.

- The number of credit card fraud reports grew from 77,355 in Q3 2019 to 104,525 in Q3 2020.

Interesting Credit Card vs. Cash Statistics in the US

1. Only 12,3% of American consumers use cash for most of their payments.

(The Ascent)

The evidence is clear that way more Americans are paying for goods and services with plastic. Recent cash vs. credit card spending statistics highlight that nearly half of consumers (45,25%) use a credit card for most transactions.

2. In 2020, debit card transaction volume surpassed credit card transactions in the US.

(Mercator Advisory Group)

In the battle of plastic, debit cards dominated, as they were used to pay for daily expenses, and last year most people focused on the essentials.

The latest credit card and debit card transaction volume statistics reflect how Americans used plastic in 2020:

While the total purchase volume fell by 7%, the results for credit and debit tell two different stories. While credit card purchases fell by 21.2% in Q2 2020, debit card volumes increased by 8.6%. This is somewhat typical for periods of recession or crisis, when consumers prefer debit over credit.

3. A 2020 report revealed that people in the US used cash for only 28% of total transactions by volume.

(McKinsey, Mastercard)

Safety concerns in 2020 drove people to resort to mostly debit card payments. Many customers and even merchants avoided cash to reduce the risk of contracting the coronavirus. In fact, most of us still prefer the cleaner option.

What does this mean for the global payment industry?

Financial institutions and individuals focused more on contactless payment in 2020. According to Mastercard, 46% of Americans swapped their old card for a contactless one.

4. Cash use sets Americans back $200 billion a year.

(TODAY)

Perhaps one of the reasons why the credit card market share has risen at the expense of cash is the fact that more and more consumers are waking up to the real cost of cash payment. Access to cash could incur charges like withdrawal fees for using a non-network automated teller machine.

5. If more businesses go cashless, cash transactions will drop from 11 to 3 payments per person per month.

(Federal Reserve Bank of San Francisco)

Wider adoption of cashless payment options will have a considerable impact on cash use. The new dominant payment culture, however, could hurt the unbanked most unless they embrace fintech-driven financial services to adapt.

Credit Card Statistics and Facts about Ownership and Usage

6. In 1970, merely 16% of the American population had a credit card.

(The Nest)

The issuance of credit cards started as a status symbol for the elite. However, as merchants saw the convenience of non-cash payment for consumers and technology advanced enough to enable banks to extend credit cards to the masses, credit card ownership quickly became the norm in the US.

7. 70.2% of US households have general-purpose credit cards.

(Credit Karma, Mercator Advisory Group)

The brands behind most of the credit card volume statistics are Visa, Mastercard, American Express, and Discover. These networks provide the infrastructure necessary to issue and process credit card transactions.

The most used credit cards in the USA, general-purpose credit cards were used in payments valued at $596 billion just in the second quarter of 2020.

8. The most popular credit cards in the USA are Visa credit cards with 336 million cards in 2020.

(Statista)

Visa is followed by two financial giants, Mastercard and Chase, which oversee the use of 230 million and 96 million credit cards in the country, respectively.

9. As of Q3 2020, there were 505.54 million open credit card accounts across the US.

(Federal Reserve Bank of New York)

Compared to the number from the same period in the previous year, the figure increased by 16.6 million accounts. Subprime credit cardholders were the main driver of growth.

10. Nearly 60% of US consumers own a cashback credit card.

(CreditCards.com)

This form of plastic is one that pays back real dollars per transaction. No wonder why a retail credit card, the kind that gives redeemable rewards, is only used by 40% of Americans.

11. Between Q4 2019 and Q2 2020, debit cards’ share of purchase volume rose from 46.4% to 55.3%.

(Mercator Advisory Group, WalletHub)

Debit cards gained the lost points of credit cards. This stat doesn’t necessarily indicate a decrease in the percentage of credit card usage in the country since it would be uncharacteristic for the average consumer to let go of one form of plastic in favor of another.

Plus, closing a credit card account, especially an old one, can be financially detrimental. The stronger interest in debit cards might just be a sign of debt management maturity.

However, as the situation in 2020 affected consumer spending habits, and made them more wary of additional expenses, the average credit card debt in 2020 decreased to $7,849 per household, compared to $8,798 in 2019.

Also, in 2020, the average credit card spending per month decreased for about 4%.

12. Consumers with an annual salary of over $100,000 use credit cards more than people with lower income.

(CNBC, The Balance)

The fact above could point to financial discipline on the part of low-income earners. After all, they are more likely to use plastic as a revolving debt instrument instead of a payment tool.

However, it’s worth noting that one of the unspoken credit card facts is that people with low income are usually less creditworthy. And someone who is in the poor or fair credit score range is less likely to be given a credit card with liberal conditions.

Severe indebtedness could get someone shut out of mainstream financial services. As a result, a debit card would be one of the few viable options to settle bills and shop without carrying cash.

13. 80% of open credit card accounts belong to consumers classified as prime and above.

(CreditCards.com)

If one would conduct some credit card industry analysis, it would be safe to assume that this stat is bound to fall.

The number of credit card usage among deep-subprime and subprime consumers increased every year (except one) between 2013 and 2019. In 2018, they collectively had 73 million open credit card accounts to their names, which was a million down from the previous year.

14. In 2021, 70% of consumers have at least one credit card.

(Shift Processing)

This credit card usage percentage includes the small number of Americans who pay with a charge card, a form of plastic that must be paid in full every month.

15. According to the latest data from 2019, 57% of undergraduate students owned a credit card.

(Sallie Mae, CreditCards.com)

In addition, 38% of undergraduates had more than one card.

These college credit card statistics are promising, as young consumers have been struggling to establish their credit. After the 2008 financial crisis, Americans under 21 were disallowed to have a credit card without a cosigner or sufficient income to handle such a financial obligation.

In 2013, only 30% of undergraduates owned a credit card.

16. 43% of college students do not carry credit cards.

(EVERFI, CreditCards.com)

Despite the relatively high figure reported last year, most college students still prefer debit over credit. The difference between the credit and debit card usage statistics was huge since 85% of undergraduates shop with plastic tied to their bank accounts.

Credit card ownership among college students jumps from 34% during their freshman year to 65% by their senior year.

The average credit card debt for college students is correlated with age. Only 28% of first-year students owe more than $1,000 while 10% more join the club by their senior year.

17. 66% of Gen Z living in the US are the most credit-active on the planet.

(CNBC)

Based on the data about credit card usage by country as well as similar stats related to other financial products, only 63% Centennials in Canada and 49% in Hong Kong are as active.

18. The average Centennial has 1.5 credit cards.

(The Nest, Pew Research Center)

This is one of the credit card ownership statistics that may be unusual but should not be surprising.

Historically, the number of plastic cards Americans own increases with time. The oldest Gen Z members will turn 23 this year, so most of them are still in school and have lighter personal finance to manage.

19. 48.5% of Gen Z is already prime.

(PaymentsSource)

It is normal for young credit users to have lower credit scores at first since they are just starting to write their own credit histories.

But Centennials are different, for nearly half of them have already crossed prime territory. It supports the claim that Gen Z-ers are more comfortable with debt than Millennials.

Being highly active credit users and responsible payers, Centennials could convince many financial institutions to increase their average American credit card limit early for the benefit of the economy.

20. In 2020, 25% of Millennials and 23% of Gen X-ers intended to apply for a new revolving line of credit.

(The Ascent, The Balance)

Opening a new credit card account could pull down credit scores in the short term, as it will decrease a consumer’s average age of active credit cards.

But the benefits of having a new credit card could outweigh its downsides. As long as the credit card debt as a percentage of credit limit does not hover above 30% and the balance is paid in full and on time every month, we could notice credit score improvements sooner rather than later.

21. Going cashless is the primary reason why 62.3% of Baby Boomers own a credit card.

(The Ascent, Investopedia)

This is a departure from the goal of most Gen X-ers and Millennials who prioritize positive credit history.

Despite the rising senior credit card debt statistics and the alarming current retirement crisis, Boomers care about debt consolidation (along with rewards and fraud protection) the least.

Statistics about Common Credit Card Mistakes

22. 77% of US consumers subscribe to the misconception that maintaining a high credit card balance is key to creditworthiness.

(New York Post, Investopedia, The Ascent)

Credit utilization is an important teller of a person’s credit story. However, the magic number is 30%. Constantly owing over 30% of an individual plastic card’s credit limit can be viewed as irresponsible behavior.

To reach superprime status, keeping the total credit card debt below 10% (the median credit utilization rate of consumers with credit scores 720 or higher) of all available credit should be your top priority.

23. 83% of American consumers wrongly believe that not zeroing out credit card balances positively affects credit rating.

(New York Post, The Balance)

Keeping a balance on a credit card will not necessarily hurt a person’s credit. Actually, paying just the minimum on time will suffice to avoid getting reported late and receiving a major credit ding as a consequence.

However, minimum payments will not do much to pull down credit utilization. Interest will be applied to the unpaid balance, which will further inflate next month’s bill. If not paid in full, the cycle will repeat itself, and the credit card debt will keep on ballooning month after month.

In other words, making the minimum payment on or before the due date can help establish a positive credit history. But it will not shrink the average credit card balance size unless regular credit usage is moderated.

24. Two-thirds of Americans allow a credit card balance to carry over the following month.

(The Ascent)

As explained above, unpaid debt is fertilizer for interest. With or without late fees, intentionally not paying what you owe fully could jack up the average credit card debt over time until it goes beyond your financial capacity. Such a scenario is the first act of many credit horror stories.

25. According to credit card default statistics, 12% of credit cardholders have been delinquent on several occasions.

(MarketWatch, Credit Karma, Statista)

A 30-day late payment will not disappear from a person’s credit report for seven years from the original delinquency date.

Longer delinquencies are more negatively impactful than shorter ones. So, letting a credit card be late 60 or 90 days when the bill could have been settled on or before day 59 would be foolish.

According to statistics, in Q2 2020, only 2.4% of credit card loans were delinquent.

26. Unpaid credit card statistics reveal that financial institutions have raked in as much as $3 billion in late fees.

(MarketWatch)

Creditors usually charge first-time late payers up to $28 and repeat offenders $39. Despite hefty fines, the inability of American consumers has been a lucrative revenue source for credit card companies.

27. One-third of Americans are more interested in great rewards than low interest rates when shopping for credit cards.

(MarketWatch, CreditCards.com)

The interest rate and annual fee, two charges that directly affect a cardholder’s cost of borrowing, are given priority by only 29% and 19% of consumers.

Since the average credit card interest rate is 17%, four times greater than those of car loans and mortgages, paying less attention to interest is among the surest routes to chronic delinquency and perpetual indebtedness.

28. Based on credit card payment statistics, almost 50% of credit cardholders do not bring their balances to zero.

(MarketWatch)

What’s even more concerning is the fact that two out of five consumers are not aware of their interest rates. Failing to zero out a credit card balance every month without knowing the penalty will almost certainly lead to financial ruin in the long run.

29. Over 51% of all US consumers have maxed out their credit cards in the past.

(The Ascent)

Gen X-ers are the most guilty of this sin since 58.8% of them have used up 100% of their available credit.

Credit Card Debt Statistics

30. 55% is the percentage of Americans with credit card debt.

(TheStreet)

Called “revolvers,” these cardholders do not pay their balances in full every month. Unlike “transactors” that zero their balances monthly to avoid interest, some revolvers believe that doing so is necessary to propel their credit scores up, while others simply bite more than they can chew.

31. The national average credit card debt per household decreased to $7,849 in Q3 2020.

(WalletHub)

This represented a 10.8% reduction in debt compared to the previous year. Americans owed more in Q3 2019, $8,798 per household.

Americans’ total credit card debt at the beginning of 2020 was over $1 trillion. Up to the end of the third quarter, they paid off enough to reduce the total debt to $926.3 billion.

32. The percentages of men and women with an average credit card bill per month of over $2,000 are 19% and 8%, respectively.

(ValuePenguin)

American female consumers tend to gravitate toward debit cards, so it’s natural that their male counterparts swipe more often and for bigger purchases.

33. The average amount of credit card debt of women is 22% less than that of men.

(ValuePenguin)

Male American consumers carry more than $7,400 in credit card balances, whereas females only have to manage less than $5,250.

34. Among 20-year-olds, the average credit card debt in America in Q2 2019 was $2,709.

(Experian)

Consumers at the age of 20 had a credit card balance of $2,310 on average. Curiously, 21-, 22-, and 23-year-olds owed less – $1,881, $1,939, and $2,180, respectively. Starting at the age of 24, consumers began to put more charges on their credit cards.

35. Alaskans, with the latest reported average credit card debt of $10,685, are the most indebted Americans (2019).

(Bankrate)

Based on the latest credit card statistics by state, completing the “high” five were Virginians ($9,120), Texans ($9,100), Marylanders ($9,009), and Connecticuters ($9,000).

36. The same report states that Iowans owed credit card companies the least, with an average credit card debt of only $6,726.

(Bankrate)

North Dakotans ($7,068), South Dakotans ($7,199), Michiganians ($7,382), and Hoosiers ($7,393) also comprised the bottom five.

37. According to statistics about the average US credit card debt by demographic group, non-Hispanic Whites owe credit card companies the most, with an average balance of $7,942.

(ValuePenguin)

Blacks carry just $6,172 in credit card debt. Considering that African-Americans have the lowest median household income among major races and ethnicities in the US, they could be considered more indebted than Whites, Asians, and Hispanics.

38. The average Afro-American household credit card debt is 20% less than the national mean.

(ValuePenguin, Black Men in America.com)

This is one of those somewhat deceiving credit card statistics in America. It does not suggest that black people are not big spenders. Because they are. And they have a lot of money to spend, $1.2 trillion in buying power, to be exact.

Like many other minorities, Blacks are less likely to seek and therefore be able to use credit as much as white consumers do because of long-standing discrimination by established financial institutions and the federal government. Many of them have experienced racism at a young age and grew up distancing themselves from banks and credit unions as a defense mechanism.

Actually, a study found out that, in 2010, about 15% of African-Americans (along with Hispanics) were credit invisible, and 13% were considered unscorable consumers. In other words, the credit card commerce statistics that year did not count them.

Sadly, the effects of having a thin credit file can follow traumatized minorities around their whole lives. Bad credit can negatively affect their ability to get employed, afford utilities with favorable conditions, and quality for financial products like credit cards.

39. A 2019 survey found that over a third of US college students owe more than $1,000 in credit card debt.

(Fox Business)

Among all college students credit card debt statistics, this one is deeply concerning. 53% of the respondents admitted that they were ill-prepared to manage their finances. Getting buried in a financial hole early could delay milestone purchases, which has sadly happened to many Millennials.

40. 78% of college students with credit cards have never been late.

(EVERFI)

Although students’ financial planning skills have been declining over the years, it’s refreshing to learn that the vast majority have never been delinquent.

Punctual payment will not only improve their college student credit card debt statistics but also help ensure that they are creditworthy enough to qualify for other financial products with more desirable conditions and cheaper interest rates.

Credit Card Fraud Facts and Figures

41. Heartland Payment Systems suffered a data breach that exposed the information of about 134 million credit cardholders.

(CSO, NBC News)

A quick review of historical online credit card theft statistics will give it the distinction as one of the biggest data heists of all time.

Although the perpetrators, led by the head of a notorious ring of cyberattackers named Albert Gonzalez, were eventually caught and were given a chance to pay their debt to society with a sentence of lengthy imprisonment, the major credit card processing company, a key data custodian, still had to pay for its shortcoming to the tune of $145 million.

42. 80% of credit cards in Americans’ wallets have been subject to data theft.

(The Washington Post)

Card-not-present cybercrime has been on the rise. Fraudsters could easily buy stolen credit card information on social media, retail websites, and online marketplaces on the dark web. Buyers could use the data to steal someone else’s identity and make unauthorized purchases.

43. 2020 credit card fraud statistics show that the number of credit card fraud reports grew from 77,355 in Q3 2019 to 104,525 in Q3 2020.

(Federal Trade Commission)

New account credit card fraud is when a criminal opens a new account using another person’s name without the victim’s knowledge. Just two years ago, there were a total of 130,928 cases. Not surprisingly, the pandemic and the ensuing economic crisis amplified the number of fraud attempts.

44. Only 29% of US credit cardholders think the risk of identity theft is real.

(The Ascent)

Just less than 17% of consumers are paranoid enough to closely monitor fraudulent activity with high frequency.

45. Credit card theft statistics highlight that 35% of Americans have been defrauded.

(The Ascent)

The usual victims are Baby Boomers – 42.6% of them have been at the receiving end of fraud. On the other hand, only 33.1% of Millennials have suffered the same fate, which is unsurprising since they are more tech-savvy than the older generations.

46. Two-thirds of the 23 million pieces of credit card information stolen across the world from January to June 2019 were issued in the US.

(CNBC Make It)

Although data heists usually happen over the internet these days, the credit card skimming statistics in America do not seem to diminish. ATM and gas pump card skimmers getting busted in different states grab headlines too often for comfort.

The Bottom Line

As with anything related to money, it’s imperative to understand the duality of credit cards in order to use them to maximum effect. Otherwise, they could be your one-way ticket to indebtedness.

Credit card statistics do not lie:

Learn how to optimize plastic for a reasonable purpose or be prepared to grow old with crushing credit card debt.

FAQ

Q: Why Do People Use Credit Cards?

64.4% of Americans confessed that building credit is their number one motivation for getting a credit card.

The next four motives are increasing spending power in case of an emergency, collecting purchase rewards, having an alternative to cash transactions, and paying for things that are otherwise unaffordable.

Q: How Many People Use Credit Cards?

More than 191 million US adults own a credit card, a charge card, or both.

While the data about credit card ownership by country say that Canada has more credit card users aged 15 and above than the US per capita, more and more Americans have stopped making cash purchases.

Q: How Many Credit Cards Does the Average American Have?

Ordinarily, American wallets contain four credit cards. In comparison, the average for Canadian ones is 2.2.

Moreover, one survey of 1,000 respondents unveiled that one in ten US consumers had six credit cards or more.

Q: How Many Credit Card Transactions per Day?

In 2019, 39.6 billion purchases made in the US were put on plastic. That was over 108,6 million credit card transactions per day. Visa, the most used credit card in the USA, handles about 1,700 transactions per second, on average.

Q: How Much Credit Card Debt Does the Average American Have?

By May 2020, a typical adult residing in the US carried $5,338 in credit card debt.

Apart from unpaid balances attached to standard credit card accounts, the “average American credit card debt” could also include unsettled bills related to consumer finance accounts, which are used to provide loans to consumers through a company. A payday loan is a shining example of such financial products.

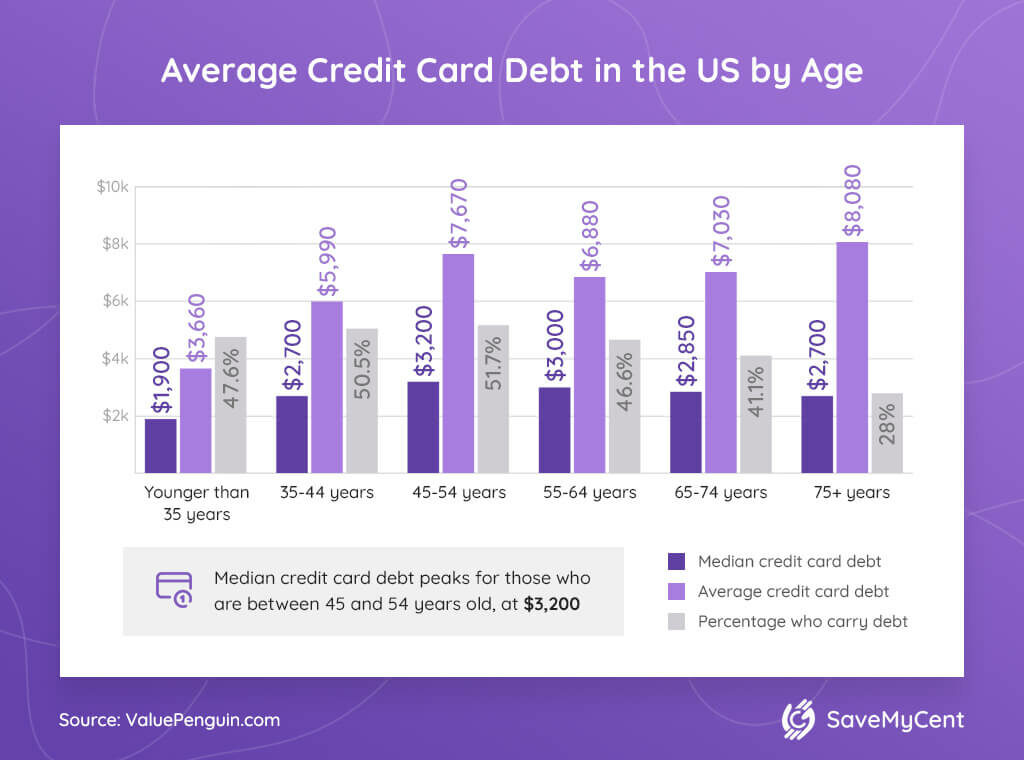

Q: What Age Group Has the Most Credit Card Debt?

Consumers in their early 50s have the highest credit card debt. According to the Q2 2019 data about the average credit card debt by age, 51-year-olds are the most indebted, with a credit card balance of $8,658.

Q: Has Credit Card Debt Increased?

The answer is negative. By the start of 2020, the US national credit card debt bloat reached $1 trillion. In 2020, consumers changed course with the greatest credit card debt paydown ever since the Great Recession. Projections say that US consumers ended 2020 with an $89 billion decrease in credit card debt.

Learn more: How to get out of debt with no money?

Sources:

- The Ascent

- CreditCards.com

- CNBC

- Bitcoin.com

- Bankrate

- Experian

- TODAY

- Federal Reserve Bank of San Francisco

- The Nest

- Credit Karma

- CreditCards.com

- The Balance

- Sallie Mae

- EVERFI

- Pew Research Center

- PaymentsSource

- The Ascent

- Investopedia

- New York Post

- Investopedia

- The Balance

- MarketWatch

- The Balance

- Credit Karma

- CreditCards.com

- TheStreet

- The Ascent

- ValuePenguin

- Bankrate

- Black Men in America.com

- CNBC

- Fox Business

- The Ascent

- CSO

- NBC News

- CNBC Make It

- Mercator Advisory Group

- McKinsey

- Mastercard

- Statista

- Statista

- Federal Reserve Bank of New York

- WalletHub

- Shift Processing

- The Washington Post

- Federal Trade Commission

- CardRates.com

![How to Get Free Clothes From Shein? [2024 Guide]](https://savemycent.com/wp-content/uploads/2023/09/How-to-Get-Free-Clothes-From-Shein-336x220.png)