The college years are a formative period in many young people’s lives — and not just because of all the fun and excitement it typically involves. It’s also the time when many of these people face their first financial challenges and start making conscious buying choices.

In this overview of college student spending statistics, you’ll learn how much of their money goes towards tuition fees and accommodation. You’ll also gain in-depth insight into students’ spending habits and find out how much their essential and non-essential costs add up to.

Top College Student Spending Statistics (Editor’s Choice)

- The average tuition for a public college in the US is $10,388.

- The tuition for a typical private college in America sits at $38,185.

- Private school students spend $12,210 a year on room and board.

- An average college student spends $260 a month on groceries.

- Undergrads spend $1,240 on average on books and supplies.

- US students spend between $300 and $1,000 per year on transportation.

- Students spent an average of $306.41 on electronics during back-to-college sales in 2021.

- An average student spends $55 a month on cell phone bills.

College Student Spending Stats: Tuition and Fees

1. The average tuition for a public college in the US is $10,388.

(US News)

This number only applies to students living in the state where they’re studying. Meanwhile, the average tuition at public colleges for out-of-state students sits at $22,698. As such, the numbers for the 2021–22 academic year indicate that the location — both that of the college and the student’s residence — is crucial when determining a typical college student budget.

2. The tuition for a typical private college in America sits at $38,185.

(US News)

US undergraduates who want to study at a private college will have to pay around 73% more than those who choose a public one, college student spending statistics reveal. Of course, various institutions offer help with paying tuition for both public and private universities. In addition, colleges themselves traditionally provide some financial aid for students in need.

But if we take a look at the Princeton University grants, for example, we’ll see that students still need to pay a hefty sum. Namely, the tuition and fees at this university total $53,890, and grants may bring this down to $23,572. So while financial aid can lower the average college student spending, it won’t remove tuition fees altogether, especially at private universities.

3. With a tuition of $61,850, Columbia has the highest fees in the United States.

(Visual Capitalist)

Despite the high tuition, Columbia University is among the most popular colleges in the US. Its acceptance rate is only 6%, suggesting a staggering number of applications submitted each year. Like many others, this Ivy League college offers financial aid and work and study programs to help each college student with their expenses. This way, even those living in households that make less than $60,000 won’t have to amass student debt to pay for tuition.

Look at: How to get out of student loan debt?

4. Brigham Young University is the cheapest college in America, with a tuition of only $5,790.

(Visual Capitalist)

Although private, the Provo, Utah-based Brigham Young University is the least expensive college in the country. Owned by the Church of Jesus Christ of Latter-day Saints, the school requires students to abide by the very strict honor code, which includes a complete ban on coffee and alcoholic beverages. This is in keeping with the Church’s traditional doctrine.

Meanwhile, the average cost of public school per student at Florida State is $21,673, making it the least expensive public college in the US. Finally, three schools at the State University of New York (SUNY) — Binghamton University ($27,791), University of Buffalo ($27,850), and Stony Brook University ($28,528) — round out the list of the five cheapest universities.

College Spending Statistics: Food and Housing

5. The average cost of room and board at a public college is $10,800.

(LendEDU)

The price is the same for both in-state and out-of-state public universities. But seeing as tuition fees are not the same at out-of-state and in-state schools, the cost of living for college students affects their overall budgets differently. Namely, room and board make up 26.4% of out-of-state college students’ total expenditure. On the other hand, with the tuition fees lower for in-state students, the cost accounts for a more significant chunk of their budget — 42.7%.

Choosing a dorm instead of a rental apartment can help reduce an average college student’s food budget, as the meals are usually included in the price. What’s more, those who choose a two-year in-district college over a four-year school will only pay $8,400 for room and board.

6. Private school students spend $12,210 a year on room and board.

(LendEDU)

According to college student spending stats, the cost of dorms at four-year private schools accounts for just under 24% of the students’ total expenses. Besides the tuition fees, which average $34,740, private school students spend $1,220 on books and supplies, $1,030 on transportation costs, and another $1,700 on additional expenditures related to college life.

7. The monthly rent for a two-bedroom student apartment averages $1,178.

(Debt.org)

Unsurprisingly, the amount of money that college students spend on rent varies based on their apartment’s location and size. Typically, students spend anywhere from a few hundred to a few thousand dollars a month on rent. And despite the perks of on-campus living, a recent survey found that off-campus accommodation was cheaper for students at 75% of big-city US universities. As such, 87% of US college students opt for off-campus living.

Researchers also note that many landlords with apartments close to the more prominent colleges are mindful of the potential renters’ incomes. As a result, the living expenses for college students in neighborhoods near these universities tend to be lower than average.

8. An average college student pays $112 a month for electricity.

(Debt.org)

Despite the lower rent, living in an apartment comes with additional costs, bills being among them. It’s good to know which appliances use the most energy and how to save on the electric bill. Besides electricity, students also pay an average of $50 a month for internet access.

The average living expenses for a college student off-campus may also include household essentials like cleaning supplies and even maintenance. Additionally, many students opt for unfurnished apartments for financial reasons. In that case, the students and their parents must buy furniture and appliances. Finally, most landlords require tenants to pay a one-off deposit and sign a 12-month lease — a longer commitment than the nine months for a dorm.

9. The average grocery bill for a college student is $260.

(Education Data Initiative)

Depending on their meal plan, students may spend anywhere between $187 (a thrifty diet) and $317 (a liberal diet) on groceries. In most cases, the US students’ grocery spending is somewhat lower than the national average. For example, whereas the average expenditure for all US students is $260, Gen-Xers spend $323 a month on groceries — 24.2% more.

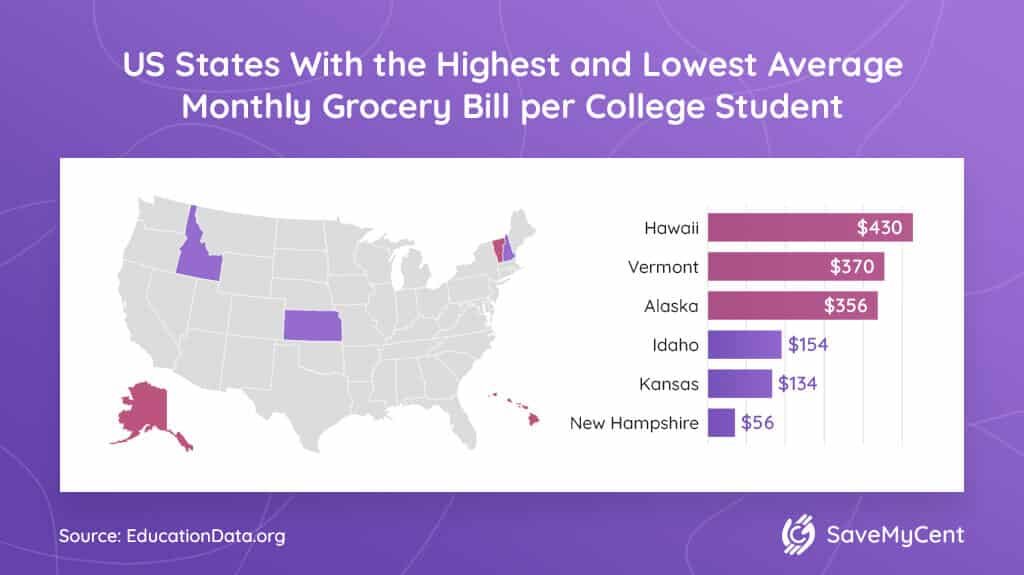

Interestingly, the average college student grocery budget varies wildly by state. Students in Hawaii ($430 per month), Vermont ($370), and Alaska ($356) spend the most on groceries. Meanwhile, Idaho ($154), Kansas ($134), and New Hampshire ($56) are the three states where the smallest portion of the college student monthly budget goes towards groceries.

10. Students spend an average of $547 a month on food.

(Education Data Initiative)

The costs of groceries, eating at home, and dining off-campus add up to about $547 each month, research reveals. College student spending habits show that they spend an average of $341 on off-campus eating and another $206 each month on home-cooked meals. For comparison, an on-campus eating plan is slightly more expensive at $563 per month. Vegan students who cook all their meals at home spend the least on food — about $200 per month.

College Students Spending Statistics: Other Expenses

11. Undergrads spend $1,240 on average on books and supplies.

(Education Data Initiative)

This number applies to students at four-year universities. In the 2020–2021 academic year, students at two-year public schools spent $1,420 on books. On the other hand, the average textbook expenses for a college student at a four-year private university were slightly lower at $1,220. And while 66% of students say they avoid buying course materials due to the high cost, many are opting for digital editions of textbooks, which saves them hundreds of dollars.

12. 25% of students work extra hours to pay for books and materials.

(Education Data Initiative)

With the high college student living expenses and tuition fees, one in four US students says they had to put in extra hours at work to afford course materials in 2020–2021. Additionally, many of them had to cut corners and make compromises for financial reasons. For example, 11% of students say they skipped meals to afford course materials. What’s more, 19% of undergraduates claim that the cost of books affected their choice of which classes to take.

13. US students spend between $300 and $1,000 per year on transportation.

(LoveToKnow)

Looking at the spending habits of college students, transportation is high on the list of their essential expenses. Depending on how far from college they live, undergrads typically spend between $300 and $1,000 per year on transportation. The annual cost is considerably higher for students who own cars, as they spend $1,000–$5,000 each year on gas and insurance.

14. Student health insurance plans range from $1,500 to $2,500 per year.

(HuffPost, ValuePenguin)

When discussing statistics about college students and money, one mustn’t overlook health insurance. In fact, most US colleges require their students to be covered by an extensive healthcare plan. And while many of these universities include health insurance as a separate item on the tuition bill, it’s often cost-prohibitive for students. On this note, a 2020 survey found that nearly 3.9 million students (5.1%) were uninsured during the global pandemic.

15. A typical student spends more than $800 on clubs, sports, and Greek life.

(Edmit)

The average monthly budget for a college student also includes extracurricular activities. The equipment and fees for various clubs and sports typically come at a high price point. In addition, “going Greek” — i.e., joining a fraternity or a sorority — can cost between $600 and a whopping $6,000, depending on the house the student decides to join. On the upside, the cost of room and board in Greek housing may sometimes be cheaper than on-campus living.

16. US students spend $2.4 billion per year on media and entertainment.

(College Marketing Group)

College student spending trends point to a rise in entertainment expenditure. In a survey conducted just before the global pandemic, 59% of students reported regularly spending money on concert tickets, while 57% said a lot of their money goes towards physical and non-physical media, including video games, online streaming, and subscription services.

17. Students spent an average of $306.41 on electronics during back-to-college sales in 2021.

(National Retail Federation)

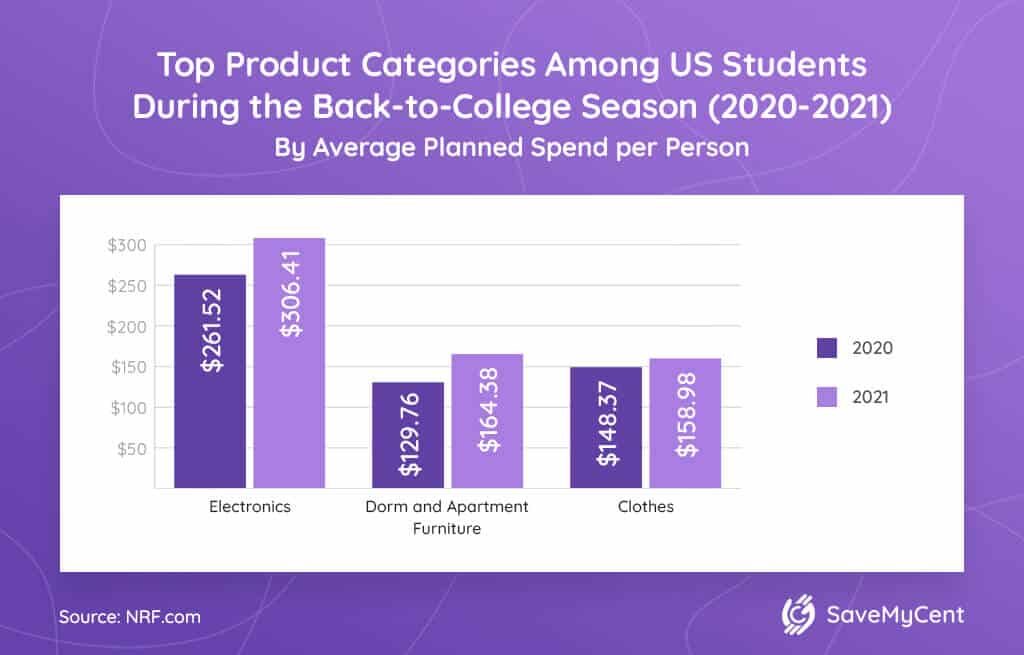

With the move to remote learning amid the COVID-19 pandemic, electronics — especially computers — shifted from non-essentials to essentials. Looking at the spending habits of college students, statistics reveal that they spent nearly $45 more on electronics in 2021 compared to 2020. During the 2021 back-to-college sales, US students also spent significant amounts of money on dorm room and apartment furniture ($164.38) and clothes ($158.98).

18. A typical student spends $30 a month on personal care.

(Edmit, Statista)

The average monthly expenses of a college student also include personal care items like skincare products, makeup, and beauty salon visits. Over the course of a school year, these costs add up to $270 per student. Many students stock up on personal care items in August, during the back-to-college season. In 2021, an average college-age customer spent $94.03 on such products during this sale, up by nearly 8% from the $87.11 they spent a year earlier.

19. College students need to set aside $100 a month for emergencies.

(Edmit, iGrad)

Emergency repairs and other unplanned costs are a major source of financial stress for college students. According to research, they add up to about $900 per academic year, meaning students should set aside $100 each month for emergencies. But these unplanned expenses typically hit at once and can deplete students’ bank accounts. On that note, 77% of students say they have temporarily run out of money at least once in the previous year.

20. An average student spends $55 a month on cell phone bills.

(Edmit, Business Wire)

While there’s no official data on how much students spend on phone bills, some estimates put the total cost at $495 for an academic year. College student spending facts suggest that this amount isn’t fixed — some students opt for more expensive plans that could cost them between $100 and $150 per month. On the other hand, many carriers offer family plans and special student discounts, which can significantly lower a college student’s cell phone bill.

Interestingly, research on college student spending behavior shows that the majority of US students don’t actually pay their phone bills out of their own pockets. Namely, 60% say their parents cover this cost every month, while only 35% always pay their phone bill themselves.

21. Laundry for college students typically costs $40 a month.

(Edmit, College Marketing Group, Education Data Initiative)

During the nine months undergrads spend in college each year, they allocate an average of $360 for laundry. In case they do their laundry off-campus, the amount can go up to $500.

But while laundry is an essential expense, there are other non-essential expenditures that contribute to a student’s average personal expenses in college. For example, 99% of US students say they frequently visit restaurants, whereas 76% spend a considerable sum of money on beauty products. Additionally, American students spend an average of $93 a month on coffee and $42 on alcohol — and the latter only applies to drinking in moderation.

College Student Spending Statistics for 2023: Final Thoughts

Despite the varying costs of public and private universities, most US college students spend the same amount of money — approximately $2,000 a month. Besides the tuition fees and room and board, the monthly allowance for college students includes essential items like food, groceries, internet and phone, and laundry. Depending on their budget, students also spend on non-essentials like beauty products, online subscriptions, and concert tickets.

To save money while buying necessities, students and their parents are increasingly taking advantage of discounts during the back-to-college sales in August. In 2021, for example, they spent the most on electronics, apartment and dorm room furnishings, and clothes.

And even though they manage to save some money on sales, a typical allowance for college students isn’t always enough to cover all the costs they incur. This is especially true in case of emergency repairs, which average $100 per month. Most students are unprepared for these expenses, and 77% of them had temporarily run out of money last year as a result.

FAQ

How much does the average college student spend?

Depending on their lifestyle and how much aid they receive, students spend between $200 and $2,500 a month during the school year. With the tuition fees and accommodation costs factored in, four-year private college students spend the most — $50,900 over the course of their education. At $17,580 on average, two-year in-district school students spend the least.

What do college students buy the most?

When it comes to non-essential items, research shows that most students spend their money in restaurants. The poor food quality and repetitiveness of the school cafeteria menu are the main reasons students choose to eat out. Other popular non-essentials include beauty products, clothes, electronics, gym memberships, media, and online subscriptions.

How much money is spent on college tuition each year?

Tuition for a public college currently averages $10,388 for in-state students. For out-of-state undergraduates, the cost of studying at a public university is higher — $22,698 on average. On the other hand, private colleges are traditionally more expensive. The tuition fees there average $38,185, but most of these schools provide grants to relieve the financial burden.

How much do college students spend on food?

With grocery shopping, home-cooked meals, and eating out all factored in, students spend about $547 per month on food. This applies to students who eat off-campus. Meanwhile, those who eat on-campus pay slightly more — $563 per month. However, this cost is usually included in the price of on-campus room and board and isn’t a separate item. Interestingly, a vegan diet consisting solely of home-cooked meals has the lowest cost at $200 per month.

How much do college students spend on alcohol?

An average US student spends $42 per month on alcohol, but this only applies to students who drink in moderation. Alcohol is an integral part of student life, with 52.5% of American students admitting to having had at least one drink in any given month. In a recent survey, 33% of students had engaged in binge drinking at least once within the previous month. For these students, the average monthly spending on alcohol is significantly higher — up to $75.

How much do college students spend on books?

Students spend an average of $1,240 on books and supplies. According to college student spending statistics, the cost varies depending on the type of college. For example, students at two-year public colleges spent $1,420 on books in 2020–2021, while those studying at four-year private schools spent $1,220. Due to their high price, 66% of students don’t buy new books, while 19% choose the classes they take based on the cost of course materials.

Sources:

![How to Get Free Clothes From Shein? [2024 Guide]](https://savemycent.com/wp-content/uploads/2023/09/How-to-Get-Free-Clothes-From-Shein-336x220.png)