It’s been roughly a decade since the subscription box business model kicked off, and the very first boxes arrived at the doors of dopamine-filled customers. Since then, the number of recurring revenue-based businesses has skyrocketed. There are many financial benefits to this model, both from the perspective of the seller and the consumer.

According to the subscription box statistics, the expansion of these types of services was not only welcomed but expected as well, given that nowadays, there isn’t much that we can’t buy and have it dropped off to our doorstep.

Where is the industry heading, and what trends and numbers we have been seeing up until now? Let’s answer those questions with some introductory editor’s fact picks first, and then dive into the nitty-gritty.

Top Facts and Stats on Subscription Box Statistics in the US (Editor’s Choice)

- In 2015, the subscription box market generated $2.6 billion.

- The global subscription box market value reached $18.8 billion in 2020.

- In 2020, the highest-paid subscription box category was food and meal kits.

- Niche products lead the industry, taking up 20% of total sales.

- Men tend to have more active subscriptions at once, as opposed to female consumers.

- 32% of all subscription boxes are replenishment-based.

- Cancellation rates are upward of 40% for all types of services.

- Box subscribers tend to be between 25 to 44 years old.

Statistics About Subscription Box Trends in the United States

1. The subscription box industry revenue grew from $57.0 million in 2011 to $2.6 billion in 2016.

(McKinsey)

The subscription box market has been growing at incredible rates. It has expanded by over 100% each year over the last half a decade. In 2011, one year after the subscription model had officially entered the market, retailers amassed only $57.0 million. However, five years later, the sales totaled at a whopping $2.6 billion. Thanks to the investments made by venture capital investors, businesses have introduced many new categories to consumers, ranging from household items to entertainment type products.

2. In 2020, the global subscription box market totaled $18.8 billion.

(IMARC)

According to an IMARC study, in 2020, the subscription box market revenue was valued at $18.8 billion. It is not an exaggeration to say that the growth of the subscription box business has been monumental, mainly because most of the brands generating revenue have not been in the industry for long.

The evidence of the addictive nature of this type of service is that the average consumer has two subscriptions, with over 30% of active consumers having three and more.

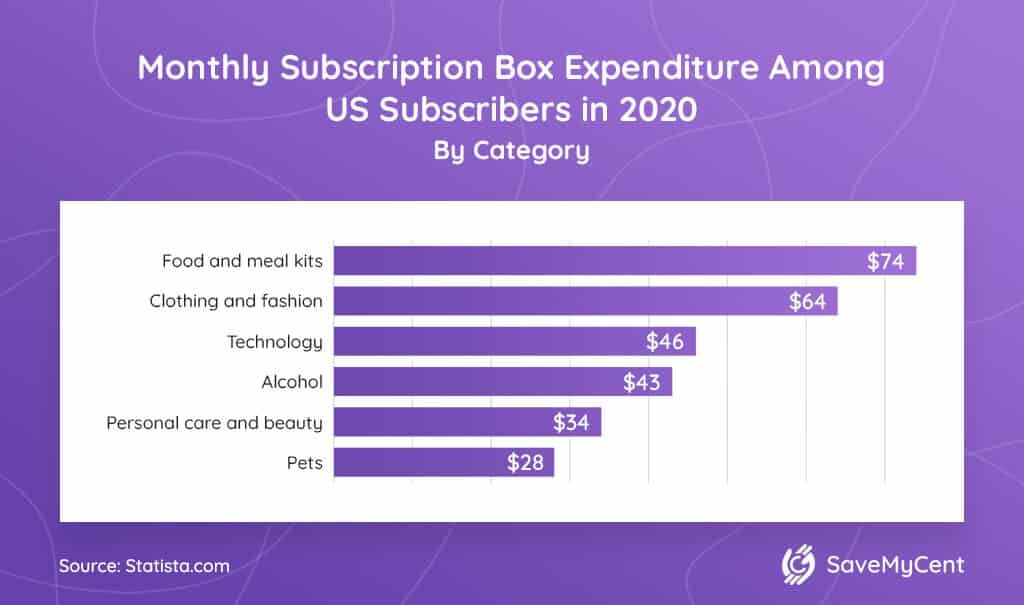

3. US consumers spent approximately $74 per month on food and meal kits, the highest-paid subscription box category in 2020.

In second place is clothing and fashion with $64 spending per month. US consumers enjoyed technology subscription boxes with an average monthly expenditure of $46. Furthermore, pet lovers spent $28 a month on their subscription boxes in 2020.

4. Global expansion is imminent, considering that 90% of brands have had international sales following the subscription box trend.

(Gravy Solutions)

Royal Mail survey showed that the subscription box market size is expected to expand across national borders. The current data shows that in 2019, close to 90% of UK based subscription businesses have had a portion of the sales internationally shipped.

This is an essential fact for the US market, as it indicates a strong trend that some US brands have already recognized. Companies such as Birchbox, Dollar Shave Club, and Harry’s have already successfully made their way into the UK market.

5. Niche products dominate 20% of the overall US subscription commerce market size.

(Gravy Solutions)

Niche products are continuing to rule the subscription box industry in 2020. Meal kits, coffee, location-specific snacks, tea, and similar niche products account for approximately 20% of the US total market. Around 15% of the market goes to hobby-related subscription boxes, which are in exceptionally high demand.

Niche products explicitly aimed toward women are unsurprisingly successful. However, what does surprise is that smaller items such as period kits, lingerie, and similar products comprise a more significant market share than fashion and clothing. This trend will continue to be on the rise, considering the success of niche products compared to general-type products.

6. Curation subscribers make up for a total of 55% of all subscriptions.

(McKinsey)

There are distinctive types of subscription services, such as access subscriptions, replenishment services, and curation services. Access services account for merely 13% of all subscriptions while replenishment services top at 32%, according to the subscription box industry analysis.

However, curation services hold an impressive 55% of all subscribers, which is a strong indication that consumers prefer spending their money on personalized products and appreciate the individual approach of the curation type brands.

7. A personalized experience is imperative to 28% of access and curation subscribers.

(McKinsey)

Once they have subscribed to a service, especially access and curation type services, customers expect to be provided with customized products. According to subscription box facts, this is not only a preference but a necessary condition. In fact, 28% of consumers of these two types of services claim they are expecting a tailored experience and an excellent value for the price to continue the subscription.

Unsurprisingly, subscription services that fall short of this demand are typically quickly canceled. This sends a clear message to the brands of their target customers and their preferences, not only in the moment but continuously throughout their journey.

8. 45% of replenishment subscriptions are at least one year long, subscription box industry analysis shows.

(McKinsey)

Even though consumers can be quick to end a service that doesn’t provide the expected experience, subscription box stats show that they will stick with it for quite some time once they discover a service they enjoy.

Surprisingly, this is particularly true for replenishment services where an impressive 45% of consumers have taken subscriptions that last at least 12 months. For access and curation services, this number drops to 35%.

Subscription Box Services Statistics

9. Top subscription box brands offer either sampling or replenishment of finished products.

(Clutch)

According to data, the most popular brands among consumers of subscription boxes offer new product sampling or replenishment of products they have already received and finished.

Out of 285 online shoppers that are considered active subscribers, Clutch found that 29% of them gave their vote to Dollar Shave Club and 21% to Ipsy when it comes to the question of top subscription brands. Blue Apron and BarkBox both have 17%, while HelloFresh stands just under with 16% of votes.

10. Subscription box industry statistics show that the market generates around $15 billion.

(McKinsey)

Subscription box sales statistics indicate that the entire subscription box market is currently holding at $15 billion. In 2017, the most prominent online subscription brands had had their sales at 30% less than just a year after when they grossed $7.5 billion.

11. 15% of US online consumers have subscribed to a service in a single year.

(McKinsey)

Even though subscriptions to streaming media services are not new, with 46% of 2019 McKinsey survey participants having a subscription to at least one online streaming service, it is safe to say that consumer goods are now catching up. The subscription box membership statistics show that just in 2018, 15% of surveyed consumers have subscribed to a consumer product service.

12. Subscription box market analysis shows that 32% of all subscription boxes are replenishment-based.

(IMPACT)

In 2018, 32% of all boxes came from subscription services based on replenishment. Curated service brands typically offer their consumers to buy high-end product samples or even full-size products at a discounted price.

One such brand is Birchbox, one of the largest subscription box companies, which sells five samples of expensive products for $10. These types of services appeal to the young population that put a lot of value on their free time and money.

13. According to subscription box statistics, big brands are jumping on the subscription box bandwagon.

(Forbes)

In 2018, the US venture capital funds for the subscription box industry was at its lowest point since 2014, investing only $318 million. However, the tides have shifted, and funding has increased significantly in 2019, topping it at $426 million. This is by a third higher than the previous year.

The industry’s success has caused several major brands to start creating products for the subscription-based market. Nike and its subscription offer for kids’ shoes are the perfect examples. This is an exciting development that may shift the financial landscape seeing how the established giants do not require venture capital funding.

14. Cancellation rates are upwards of 40% for all types of services.

(McKinsey)

Retaining customers has proven to be a big problem. Despite the subscribe box effect and efforts to create a tailored experience for their consumers, subscription box companies have issues with the cancellation rates. According to the McKinsey study, the rate is almost 40% across the industry.

Having customers choose to stick around for longer has especially been a critical problem for types of services that offer perishable products such as meal kits. The rate of canceled services can go over 70% within the first six months of subscribing to the service.

Subscription Box Demographics Stats and Facts

15. 31% of millennials are on board for the retail subscription box trend.

(USA Today, First Insight)

Compared to only 8% of boomers who are paying for a retail subscription, 38% of millennials that aren’t currently using any services said that they are planning to subscribe to a recurring service in the next half a year.

According to First Insight study, several factors drive millennials’ purchase decisions — flexibility, convenience, customization, and especially the brand values that need to align with their own. The subscription-based model aims to hit all those targets at once.

16. Subscription box statistics show that subscribers tend to be between 25 to 44 years old.

(McKinsey)

Consumers that subscribe to recurring monthly services tend to live in urban areas and are 25 to 44 years old. Their income ranges between $50,000 and $100,000. It’s evident how these consumers can be drawn to the most popular monthly subscription boxes, such as those from HelloFresh that offer popular meal kits or Ipsy and its personalized beauty products.

17. More than 60% of subscription box consumers are women, but men have a higher number of active subscriptions.

(McKinsey)

Subscription box market research indicates that women dominate the consumer part of the statistics, with over 60% of subscribers being women and only 42% being men. Even so, male subscription box statistics show that men tend to pay for three or more services, unlike 28% of women who do the same.

This data suggests that subscription-based brands should consider catering more of their services to men as they seem to enjoy the practicalities of recurring product delivery.

18. As of 2017, nearly 50% of subscribed women are spending under $11 a month on a box.

(Statista)

Female consumers living in the United States seem to prefer subscription box services that provide beauty products. According to the survey done in May 2017, most successful subscription boxes contain beauty and other cosmetic-related products. Around 48% of female subscribers to beauty products spent a maximum of $11 for the service each month.

Conclusion

Only ten years ago, the subscription box industry was just starting to break into the consumer market. These days, the market generates around $15 billion. It’s obvious why consumers are attracted to these types of products considering the high level of practicality and customized boxes that brands offer.

Even though more than 60% of all subscribers are women, it comes as a surprise that men are the ones that have a higher number of active subscriptions. This fact alone offers significant insight into the types of efforts brands need to focus on, especially when taking into account consumers’ demographic characteristics. Tailored experience and replenishment products take the cake when it comes to trends that sways the consumer market into subscribing or canceling a specific subscription.

Having these facts and statistics at hand is imperative if you’re thinking about customizing your subscription box offers further.

FAQ

Are subscription boxes a waste of money?

If you enjoy the convenience and the surprise factor subscription boxes offer, think about how it plays out for you. Asking yourself whether you are utilizing a specific product or a service on a monthly basis is a good start.

If you find that you are freeing up time for yourself by receiving these products or even saving money compared to buying the products individually, subscription boxes just might be a great option for you.

What subscription boxes are worth it?

If you take into account thousands of different products and services on offer, you can understand how hard it is to answer this question. Weighing whether a subscription is cost-effective for you may be the best approach.

If you own a dog, subscribing to a BarkBox every month for less than $20 might appear to be an exciting deal. However, if you consider annual expenditure, the picture might look different to you. If you would typically spend even more than what BarkBox costs, then a subscription box might be just what you need.

What is the most popular subscription box?

According to McKinsey, the most popular subscription brands in 2018 were Amazon Subscribe & Save, Dollar Shave Club, Ipsy, Blue Apron, and Birchbox. In 2019, Clutch’s survey revealed that the top five subscription box brands were Dollar Shave Club, Ipsy, Blue Apron, BarkBox, HelloFresh, and Birchbox.

Although these statistics change all the time as there are hundreds of new brands appearing each day, what we do know is that replenishment services seem to be a consistent favorite of many customers.

Why are subscription boxes here to stay?

According to Psychology Today, many consumers can’t decide on their purchase when confronted with a vast number of choices. The more choices we have, the harder it becomes to come to a decision on what to pick, which in turn makes us unlikely to buy anything.

Subscription boxes simplify this process significantly and let the personalization process take center stage. McKinsey study indicates that 28% of surveyed people point to personalized experience as the principal reason for prolonging the subscription.

Another reason why subscription boxes are probably not going anywhere is that specific feeling we get when expecting something pleasant to happen. The intoxicating dopamine rush we feel when anticipating the arrival of the box and finally getting to open it without knowing what it contains is similar to the exhilaration people feel when gambling.

While makeup boxes or meal kits might not be on par with gambling, the uncertainty of the ‘’reward’’ content and waiting for it to arrive set off similar areas of the brain, which makes it quite addicting.

How many subscription services are there?

There seems to be anywhere between 400 to 600 subscription box services in the United States. However, the exact number is hard to track, given how many new businesses pop up every day. More often than not, these brands cover a wide variety of customer needs and specialized interests with a price range of $10 to $100.

If you consider starting a subscription box business, you should learn how to launch and succeed in this market.

How many subscribers does the average subscription box have?

Subscription box statistics are extremely useful for many types of stats and facts. However, it’s not easy to answer this question. Nonetheless, we know that Birchbox, as one of the biggest and most popular brands in the subscription box space, has amassed over 1 million active subscribers as of 2019. The tides are ever-changing in the ecommerce landscape, so we can expect these figures to change rather frequently.

Sources:

![How to Get Free Clothes From Shein? [2024 Guide]](https://savemycent.com/wp-content/uploads/2023/09/How-to-Get-Free-Clothes-From-Shein-336x220.png)